Inflation is a pervasive economic force that impacts our daily lives and financial stability. Understanding how to leverage inflation to benefit your finances and protect your wealth are essential skills in today’s uncertain economic landscape. In this blog post, we will explore innovative strategies and practical tips to preserve your wealth in the face of inflation.

The Importance of Protecting Yourself against Inflation

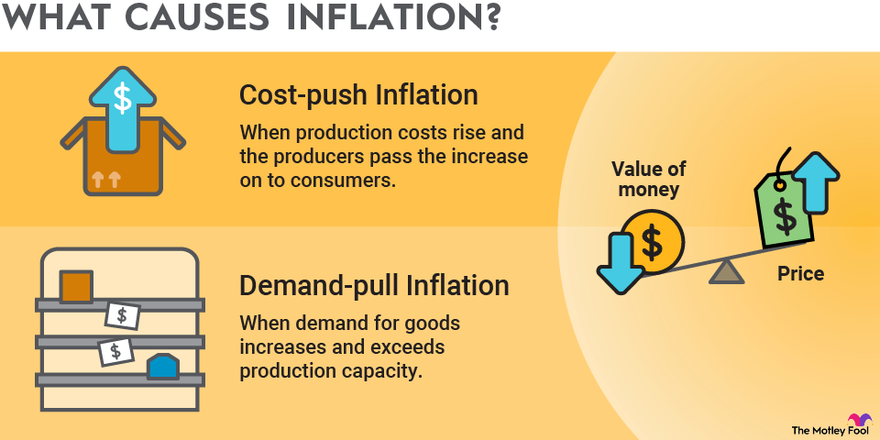

Inflation is the gradual increase in the prices of goods and services over time. While a moderate level of inflation is considered healthy for an economy, it erodes the purchasing power of individuals. We will delve into the real-world impact of inflation and how unprotected assets can lead to financial vulnerability.

To safeguard your wealth, it is crucial to take proactive measures to counteract the effects of inflation. We will explore the necessity of protecting yourself against inflation and discuss the long-term consequences of neglecting this important aspect of financial planning.

Utilizing Inflation as an Investment Strategy

Inflation can also be viewed as an opportunity for financial growth if you understand how to utilize it to your advantage. We will discuss the concept of inflation-adjusted investments and explore various assets that tend to resist the erosive effects of inflation. Real estate, for instance, is known for its ability to appreciate in value over time, making it a potential inflation-resistant investment.

Making Inflation Work for You: Practical Tips and Techniques

Building on the previous section, we will provide practical tips and techniques for harnessing the power of inflation. Negotiating raises or adjusting your income to keep up with inflation can help alleviate the financial burden. Additionally, we will explore high-yield bonds and the balance between saving and investing in the context of beating inflation.

Image courtesy of via Google Images

Long-Term Planning for Inflation Protection

Inflation hedging is a crucial aspect of long-term financial planning. We will discuss tailoring strategies to adapt to varying economic conditions and protecting your retirement savings from the impacts of inflation. This section emphasizes the importance of seeking professional advice from financial advisors to develop optimal inflation protection strategies.

Embracing the Inflation Mindset

To truly harness the power of inflation, it requires adopting a mindset that sees it as an opportunity rather than a threat. We will discuss the perspective shift needed to view inflation as a chance for growth and resilience during times of economic crisis. Continuous learning and staying informed are also essential in mastering inflation-proofing techniques.

Image courtesy of via Google Images

Final Thoughts

In conclusion, protecting yourself against inflation is paramount to sustaining financial growth and preserving your wealth. By understanding the basics of inflation, utilizing it as an investment strategy, implementing practical tips, engaging in long-term planning, and adopting the inflation mindset, you can navigate the ever-changing economic landscape and secure a prosperous future.