Exploring the Impact of Quantitative Easing on the Economy

Quantitative Easing (QE) is a monetary policy tool utilized by central banks to stimulate the economy by increasing the money supply and lowering interest rates. This blog post will delve into the history, mechanics, impact, and case studies of QE to better understand its role in shaping economic landscapes around the world.

History of Quantitative Easing

Quantitative Easing first gained attention during the global financial crisis of 2008 when central banks, including the Federal Reserve in the United States and the Bank of England, used this unconventional tool to combat the economic downturn. Since then, QE has been employed in various forms and scales in response to economic challenges and uncertainties.

The Mechanics of Quantitative Easing

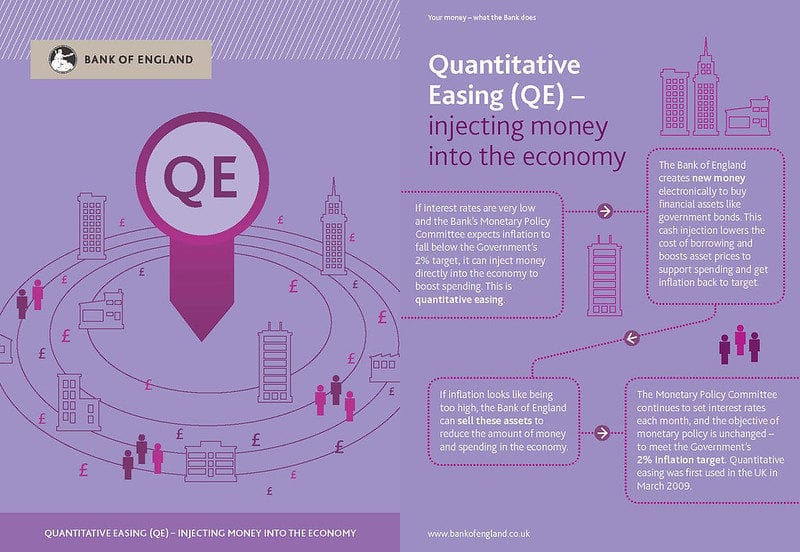

Central banks implement QE by purchasing government securities and other assets from the open market. This influx of liquidity aims to boost lending and investment, as well as lower long-term interest rates. By expanding the central bank’s balance sheet, QE increases the money supply in the economy.

Image courtesy of www.physicalgold.com via Google Images

The Impact of QE on the Economy

The potential benefits of QE include stimulating economic growth, lowering borrowing costs for businesses and consumers, and encouraging risk-taking and investment. However, QE can also have downsides such as inflationary pressures and the risk of creating asset price bubbles that may lead to financial instability.

Case Studies of Quantitative Easing

Various countries have implemented QE programs with differing degrees of success. The United States deployed QE during the aftermath of the financial crisis, helping to stabilize the economy and spur growth. In Japan, QE has been a key tool in combating deflation and promoting economic expansion. The European Central Bank also utilized QE to address economic challenges within the Eurozone.

Image courtesy of quizlet.com via Google Images

Final Words

Quantitative Easing is a powerful monetary policy tool that central banks can use to address economic challenges and stimulate growth. While it offers benefits such as increased liquidity and lower borrowing costs, it also poses risks such as inflation and asset bubbles. Understanding the history, mechanics, and impact of QE is crucial in navigating the complex world of monetary policy and its implications for the economy.