Credit Default Swaps (CDS) are complex financial instruments that play a crucial role in managing credit risk in the financial markets. In this blog post, we will delve into the workings of CDS, explore their benefits and risks, examine the regulatory landscape, and analyze real-world examples to understand their impact on the financial industry.

How CDS Works

A Credit Default Swap is a derivative contract between two parties, the protection buyer, and the protection seller, where the buyer makes periodic payments to the seller in exchange for protection against the default of a specified debt instrument, such as a corporate bond or loan. The seller agrees to compensate the buyer in the event of a credit event, such as default or bankruptcy.

CDS are used as a risk management tool to hedge against potential losses resulting from credit events. For example, a hedge fund that holds a portfolio of corporate bonds may purchase CDS to protect against the risk of default on those bonds. In this way, CDS offer investors a way to mitigate credit risk and diversify their portfolios.

Benefits and Risks of CDS

One of the key advantages of using CDS is that they allow investors to gain exposure to credit markets without owning the underlying asset. This can provide liquidity and flexibility in managing risk. However, CDS also come with inherent risks, including counterparty risk, where the protection seller may not be able to honor its obligations in the event of a credit event. Market volatility can also impact the value of CDS contracts, leading to potential losses for investors.

It is important to distinguish between buying and selling CDS. Buyers of CDS, known as protection buyers, pay premiums to the seller in exchange for protection. Sellers of CDS, on the other hand, receive premiums but assume the risk of having to pay out in the event of a credit event. This dynamic creates a market for investors to manage risk and speculate on credit outcomes.

Regulation of CDS

Following the 2008 financial crisis, regulators implemented measures to enhance oversight of the CDS market and reduce systemic risks. Regulatory changes included requirements for central clearing of CDS trades, increased transparency in reporting transactions, and limits on speculative trading. These reforms aimed to strengthen the stability of the financial system and prevent future crises caused by excessive risk-taking in the derivatives market.

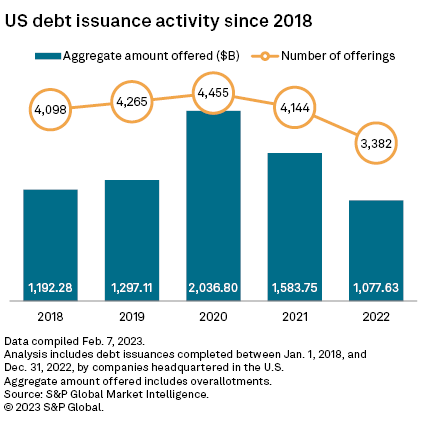

Image courtesy of www.spglobal.com via Google Images

Real-world Examples of CDS

One notable example of CDS in action is the case of the 2008 financial crisis, where the collapse of the subprime mortgage market led to widespread defaults on mortgage-backed securities. Investors who held CDS protection were able to hedge their exposure to these risky assets, while those who sold protection faced significant losses. This event underscored the importance of risk management and the potential impact of CDS on financial stability.

On the other hand, there have been instances where CDS have been misused for speculative purposes, leading to market distortions and increased volatility. Understanding the risks and benefits of CDS is essential for investors and institutions to make informed decisions and manage their exposure to credit risk effectively.

In Conclusion

In conclusion, Credit Default Swaps are powerful financial instruments that serve as a key tool for managing credit risk in the financial markets. While they offer benefits such as risk mitigation and portfolio diversification, they also come with risks that must be carefully managed. Regulatory oversight and transparency are essential to ensure the stability and integrity of the CDS market. By understanding the ins and outs of CDS, investors and institutions can navigate the complexities of the financial derivatives market with greater confidence and insight.