Growth is the oxygen of business. It is a relentless journey towards better. It doesn’t necessarily mean being the biggest, but it does mean driving progress. Doing more, achieving more. Yes, over time, it needs to be profitable. And yes, it needs to be sustainable, enduring, and with positive impact.

So what drives, sustains, and accelerates profitable growth? Here, we explore some of the most interesting growth companies, with links to their latest performance – selected to demonstrate different approaches to growth, as well as their performance.

- Amazon

- Authentic Brands

- Coca-Cola

- Crocs

- Essilor Luxottica

- LVMH

- 1. Strategic Acquisitions and Diversification

- 2. Brand Rejuvenation and Synergies

- 3. Focus on Innovation and Craftsmanship

- 4. Expanding Global Footprint

- 5. Digital Transformation and E-commerce

- 6. Customer Experience and Retail Excellence

- 7. Sustainability and Corporate Responsibility

- 8. Leadership and Vision

- Mercado Libre

- Nubank

- Nvidia

- On

- 1. Innovation at the Core: Revolutionizing Running Shoes

- 2. Customer-Centric Approach: Listening and Adapting

- 3. Strategic Partnerships and Collaborations

- 4. Expanding Product Lines: Beyond Running Shoes

- 5. Entering New Markets: Global Expansion

- 6. Sustainability and Social Responsibility

- 7. Leveraging Technology and Digital Marketing

- Ping An

- Temu

- 1. Leveraging Parent Company’s Ecosystem

- 2. Aggressive Market Entry and Expansion

- 3. On-Demand Business Model

- 4. Social Media and Digital Marketing

- 5. Gamification and Relentless Offers

- 6. Focus on Customer Experience

- 7. Data-Driven Decision Making

- 8. Strategic Partnerships and Collaborations

- 9. Commitment to Innovation

- 10. Building a Strong Brand Identity

- Tencent

- Tesla

- Tony’s Chocolonely

- 1. Mission-Driven Purpose: Fighting Modern Slavery

- 2. Transparency and Traceability

- 3. Unique Product Offering

- 4. Effective Storytelling and Marketing

- 5. Strategic Market Expansion

- 6. Innovative Collaborations and Partnerships

- 7. Focus on Sustainability and Social Impact

- 8. Engaging Packaging and Branding

- 9. Active Community Engagement

- 10. Continuous Innovation and Product Development

- What Drives Growth?

- Frequently Asked Questions (FAQs) on Profitable Growth

- What is profitable growth?

- Why is long-term vision important for growth?

- How does technology drive business growth?

- Can growth be sustainable and profitable at the same time?

- What role does customer-centricity play in growth?

- How do you drive and sustain profitable growth?

- Does it mean doing more? Or less, by doing the best things better?

- Is it all about smarter selling, or more about innovating?

- To existing markets and customers, or looking beyond to new opportunities?

- How does growth fit with sustainability, and using fewer natural resources?

- Can inorganic growth replace the need for real, organic growth?

- Is growth still the primary way to drive long-term value creation financially?

- Does growth need a strategy, and active leadership, or is it just a result?

- Wrapping Up

Amazon

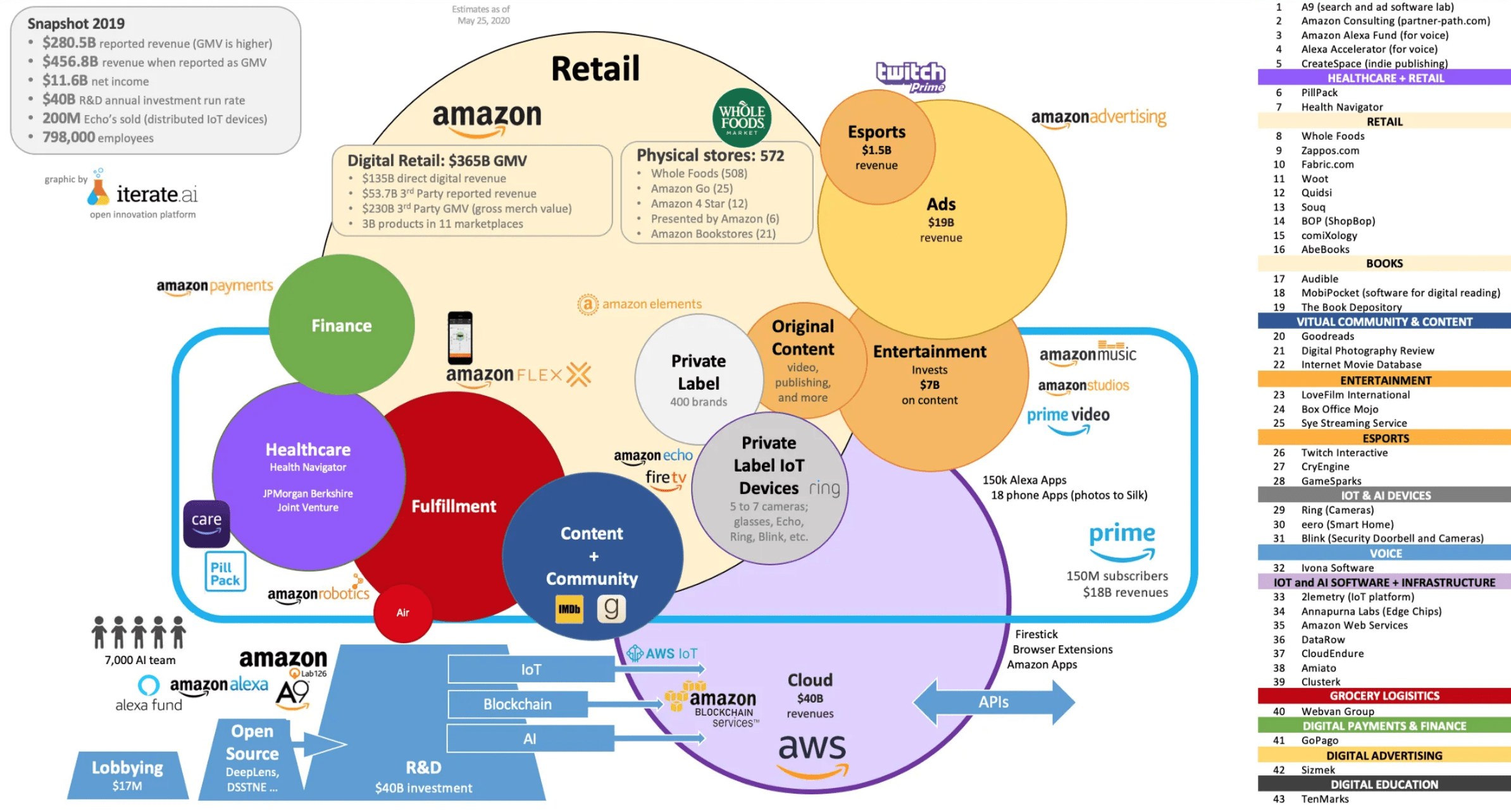

“Earth’s most customer-centric company” has been a relentless growth business for over more than 25 years, from an online bookstore to an everything store, since Jeff Bezos started out in his garage, back in 1994. Critical to growth has been a long-term perspective, driven initially by private ownership, extension to a marketplace platform, the broader partner ecosystem, the flywheel model, Prime customer membership, and its most profitable business, AWS.

Amazon’s growth over the years has been driven by a combination of strategic initiatives, relentless innovation, and a customer-centric approach. Here’s an in-depth look at the key factors that have fueled Amazon’s impressive expansion:

1. Long-Term Vision and Investment

From the very beginning, Amazon’s founder Jeff Bezos emphasized a long-term vision over short-term profits. This approach allowed Amazon to invest heavily in infrastructure, technology, and market expansion without the immediate pressure of profitability. Bezos’s focus on the long-term has enabled Amazon to build a robust foundation for sustainable growth.

2. Customer-Centric Philosophy

Amazon’s mission to be “Earth’s most customer-centric company” has been a cornerstone of its strategy. This philosophy drives every decision at Amazon, from product development to customer service. By continuously enhancing the customer experience through convenience, competitive pricing, and extensive product selection, Amazon has built a loyal customer base.

3. Diverse Revenue Streams

Amazon has diversified its revenue streams significantly beyond its original e-commerce platform. Key areas include:

- Amazon Web Services (AWS): Launched in 2006, AWS provides cloud computing services and has become Amazon’s most profitable division.

- Amazon Prime: A subscription service offering free shipping, streaming video and music, and other benefits, which has attracted millions of loyal customers.

- Marketplace: Amazon allows third-party sellers to list products on its platform, creating a comprehensive marketplace that offers a vast selection of products.

- Advertising: Amazon’s growing advertising business leverages its data on customer preferences and purchasing behavior.

4. Technological Innovation

Amazon has consistently invested in technology to improve its operations and customer experience. Innovations include:

- Recommendation Algorithms: Advanced algorithms that personalize the shopping experience by recommending products based on customer behavior.

- Amazon Echo and Alexa: Voice-activated smart devices that have positioned Amazon as a leader in the smart home market.

- Automation and Robotics: Use of robotics in fulfillment centers to increase efficiency and reduce costs.

5. Global Expansion

Amazon’s strategic international expansion has opened new markets and revenue streams. The company has localized its platform to suit different regions, adapting to cultural and regulatory environments to ensure successful market penetration.

6. Acquisitions and Partnerships

Amazon has grown through strategic acquisitions and partnerships. Notable acquisitions include:

- Whole Foods Market: Acquired in 2017, this move helped Amazon gain a foothold in the physical grocery market.

- Zappos, Audible, Twitch: These acquisitions have diversified Amazon’s offerings and expanded its customer base.

7. Innovative Business Models

Amazon has introduced innovative business models that disrupt traditional industries. Examples include:

- Amazon Prime: This subscription model not only generates recurring revenue but also increases customer loyalty and spending.

- Fulfillment by Amazon (FBA): A service where Amazon handles storage, packaging, and shipping for third-party sellers, making it easier for small businesses to reach a global audience.

8. Efficient Logistics and Supply Chain

Amazon’s sophisticated logistics and supply chain management are critical to its success. The company continuously optimizes its delivery network to offer fast and reliable shipping options, including same-day and next-day delivery in many areas. Investments in warehouse automation, drone delivery, and electric delivery vehicles further enhance efficiency.

9. Commitment to Innovation

Amazon fosters a culture of innovation, encouraging employees to experiment and think big. The company’s commitment to “Day 1” philosophy, where each day is treated as the first day of the company’s existence, ensures that it remains agile and responsive to changes in the market.

10. Data-Driven Decision Making

Amazon leverages big data and analytics to make informed decisions across all areas of its business. From inventory management to personalized marketing, data-driven insights help Amazon optimize operations and enhance the customer experience.

Amazon’s growth has been driven by a combination of visionary leadership, a relentless focus on customer satisfaction, strategic diversification, and continuous innovation. By maintaining a long-term perspective and adapting to changing market dynamics, Amazon has positioned itself as a dominant player in multiple industries, ensuring sustained growth and profitability.

Authentic Brands

Jamie Salter leads Authentic, experts in taking tired old brands and finding new growth. Authentic started with celebrity brands – like Marilyn Monroe and Elvis Presley, and more recently David Beckham. Since then, it has rejuvenated brands including Reebok, Forever 21, Juicy Couture, Nine West, and Ted Baker. The business model is to take charge of the brand and business strategy, while leaving partners to operate and create synergies between brands.

Authentic Brands Group (ABG) began its journey by acquiring and revitalizing iconic celebrity brands. The initial focus was on names like Marilyn Monroe and Elvis Presley. By leveraging the timeless appeal and global recognition of these celebrities, ABG laid a strong foundation for its growth. The company capitalized on the nostalgic value of these brands, ensuring they remained relevant in contemporary markets through strategic licensing and marketing efforts.

1. Expansion into Fashion and Lifestyle

After establishing a strong portfolio of celebrity brands, ABG expanded into the fashion and lifestyle sectors. This strategic move involved acquiring brands that had significant market presence but were struggling to maintain relevance and profitability. Key acquisitions included:

- Juicy Couture: Once a highly popular brand, Juicy Couture had lost its luster. ABG revitalized it by modernizing its image and expanding its product lines.

- Nine West: A well-known name in women’s footwear, ABG restructured its operations and expanded its market reach.

- Reebok: Acquiring this iconic sportswear brand allowed ABG to enter the lucrative athletic apparel market, enhancing its portfolio with a globally recognized name.

2. Strategic Brand Management

One of ABG’s core strategies is to take charge of the brand and business strategy while leaving operational execution to experienced partners. This approach allows ABG to focus on creating synergies between its diverse portfolio of brands. By managing brand strategy centrally, ABG ensures consistency and leverages cross-promotional opportunities.

3. Creating Synergies Between Brands

ABG’s portfolio includes a diverse range of brands across different market segments. The company creates synergies by finding commonalities and complementary aspects between its brands. For instance, collaborations between lifestyle brands and celebrity endorsements create a mutually beneficial relationship that enhances the visibility and appeal of both parties involved. This strategic integration amplifies brand value and market presence.

4. Innovative Marketing and Licensing

ABG has excelled in innovative marketing and licensing strategies. By partnering with leading retailers, fashion designers, and media companies, ABG extends the reach of its brands. Licensing agreements allow ABG to tap into new markets and product categories without significant capital investment. This model enables rapid expansion and diversification of revenue streams.

5. Focus on Digital Transformation

In recent years, ABG has embraced digital transformation to drive growth. By leveraging e-commerce platforms and social media, ABG reaches a broader audience and engages directly with consumers. The digital strategy includes partnerships with leading online retailers and investment in direct-to-consumer channels, ensuring that its brands remain accessible and relevant in the digital age.

6. Acquisition of Struggling Retailers

ABG’s growth strategy also involves acquiring struggling retailers and turning them around. This approach not only revives failing businesses but also expands ABG’s retail footprint. For example, the acquisition of Forever 21 allowed ABG to tap into the fast-fashion market while rejuvenating a once-popular brand.

7. Data-Driven Decision Making

ABG utilizes data analytics to make informed decisions regarding brand management, marketing strategies, and market expansion. By analyzing consumer behavior, market trends, and brand performance, ABG continuously optimizes its strategies to ensure sustained growth.

Authentic Brands Group has driven growth through a combination of strategic acquisitions, innovative brand management, and a focus on creating synergies between its diverse portfolio. By revitalizing iconic brands, embracing digital transformation, and leveraging data-driven strategies, ABG has positioned itself as a leader in brand development and management. Its unique approach of managing brand strategy while partnering for operational execution has allowed ABG to maintain a lean structure and focus on long-term growth and profitability.

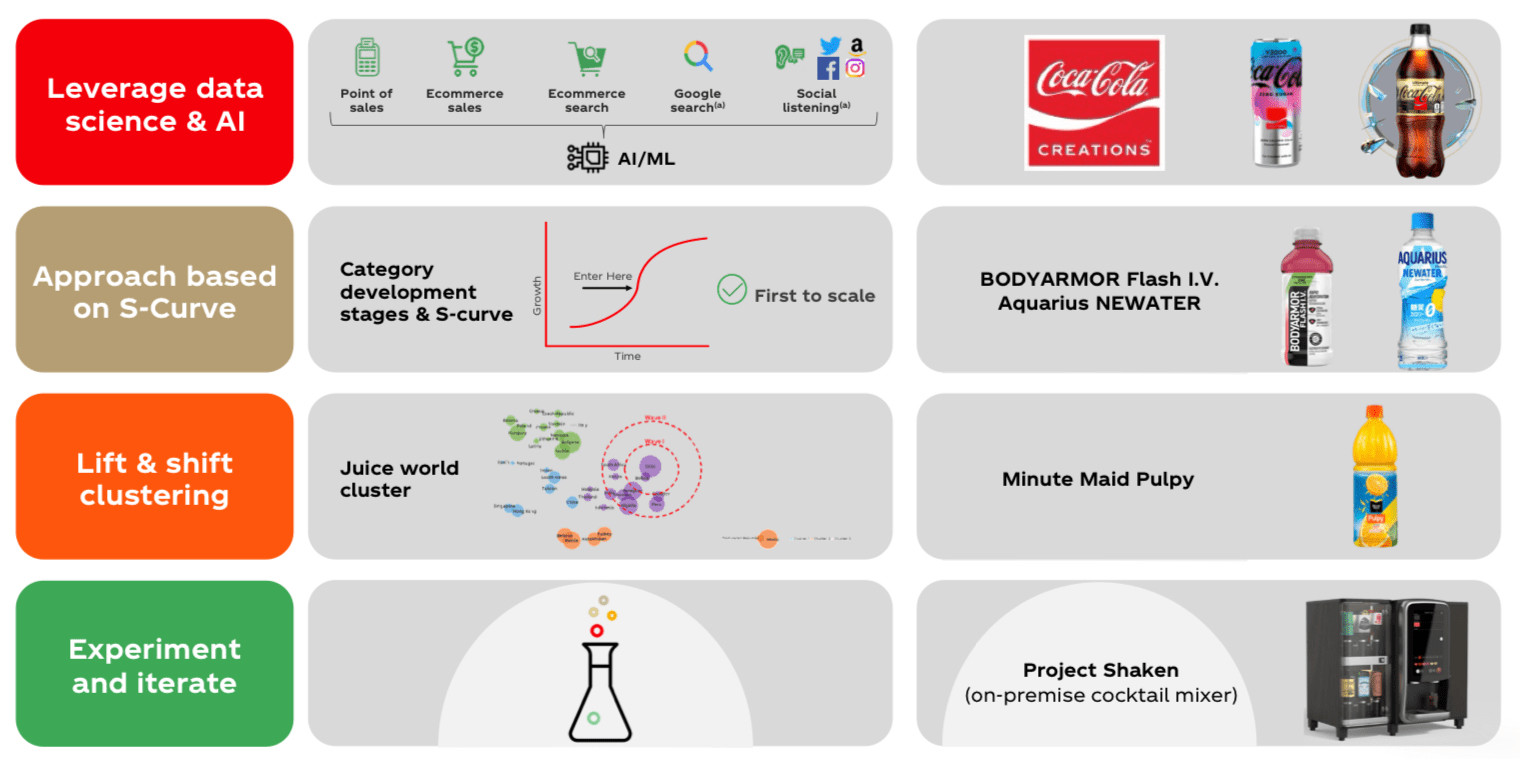

Coca-Cola

Growth becomes harder as a business matures. Coca-Cola has learned to keep evolving as markets, consumer tastes, and cultures change. Key has been to retain a “human-centric” approach to brand experience, with deep insight into consumers and the broader cultural context, leading to identifying new niches, new products, new channels, new engagement, and an ever-shifting portfolio.

Innovation examples include AI-driven Coca Cola Creations and Project Shaken, a cocktail mixer. Here’s how Coca-Cola has driven growth over the years:

1. Brand Evolution and Extension

Coca-Cola has continuously evolved its brand to stay relevant in changing markets. This includes:

- New Product Development: Introducing new beverages, such as Diet Coke, Coca-Cola Zero, and flavored variants, to cater to diverse consumer preferences.

- Acquisitions: Expanding its portfolio by acquiring brands like Minute Maid, Dasani, and more recently, Costa Coffee and Fairlife.

2. Marketing and Advertising Excellence

Coca-Cola’s marketing strategies have been iconic and instrumental in its growth:

- Global Campaigns: Memorable campaigns like “Share a Coke,” “Taste the Feeling,” and seasonal advertisements that resonate with a broad audience.

- Sponsorships and Partnerships: Partnering with global events like the Olympics and FIFA World Cup to increase brand visibility.

3. Innovation in Consumer Engagement

Coca-Cola has adopted innovative approaches to engage with consumers:

- AI and Digital Initiatives: Utilizing AI to create personalized marketing and develop new products through Coca-Cola Creations.

- Interactive Experiences: Leveraging social media and digital platforms to create interactive and engaging consumer experiences.

4. Expanding Distribution Channels

To ensure its products are available everywhere, Coca-Cola has:

- Global Distribution Network: Developed one of the world’s most extensive distribution networks, reaching over 200 countries.

- Partnerships with Retailers: Collaborated with major retail chains and local stores to ensure product availability across diverse markets.

5. Sustainable Practices

Coca-Cola has committed to sustainability to meet the growing demand for eco-friendly products:

- Water Stewardship: Initiatives to replenish water used in their beverages.

- Recycling and Packaging: Goals to make all packaging 100% recyclable by 2025 and to use more sustainable materials.

6. Localized Strategies

Coca-Cola tailors its approach to fit local tastes and preferences:

- Product Customization: Offering products that cater to regional flavors and preferences.

- Localized Marketing: Creating marketing campaigns that resonate with local cultures and traditions.

7. Human-Centric Approach

A key aspect of Coca-Cola’s strategy is its focus on the consumer:

- Consumer Insights: Investing in research to understand consumer behavior and preferences deeply.

- Community Engagement: Initiatives that support local communities and create a positive brand image.

8. Diversification Beyond Beverages

Recognizing the changing landscape, Coca-Cola has diversified:

- Health and Wellness: Investing in health-oriented beverages like juices, plant-based drinks, and low-calorie options.

- Expanding into Coffee and Tea: With acquisitions like Costa Coffee, Coca-Cola is tapping into the growing coffee and tea market.

Coca-Cola’s growth has been driven by a blend of innovation, strategic marketing, and a deep understanding of consumer needs. By continuously evolving its product offerings, expanding its market reach, and committing to sustainability, Coca-Cola has maintained its position as a leader in the global beverage industry. These strategies illustrate how the company has not only driven growth but also adapted to remain relevant in a constantly changing market.

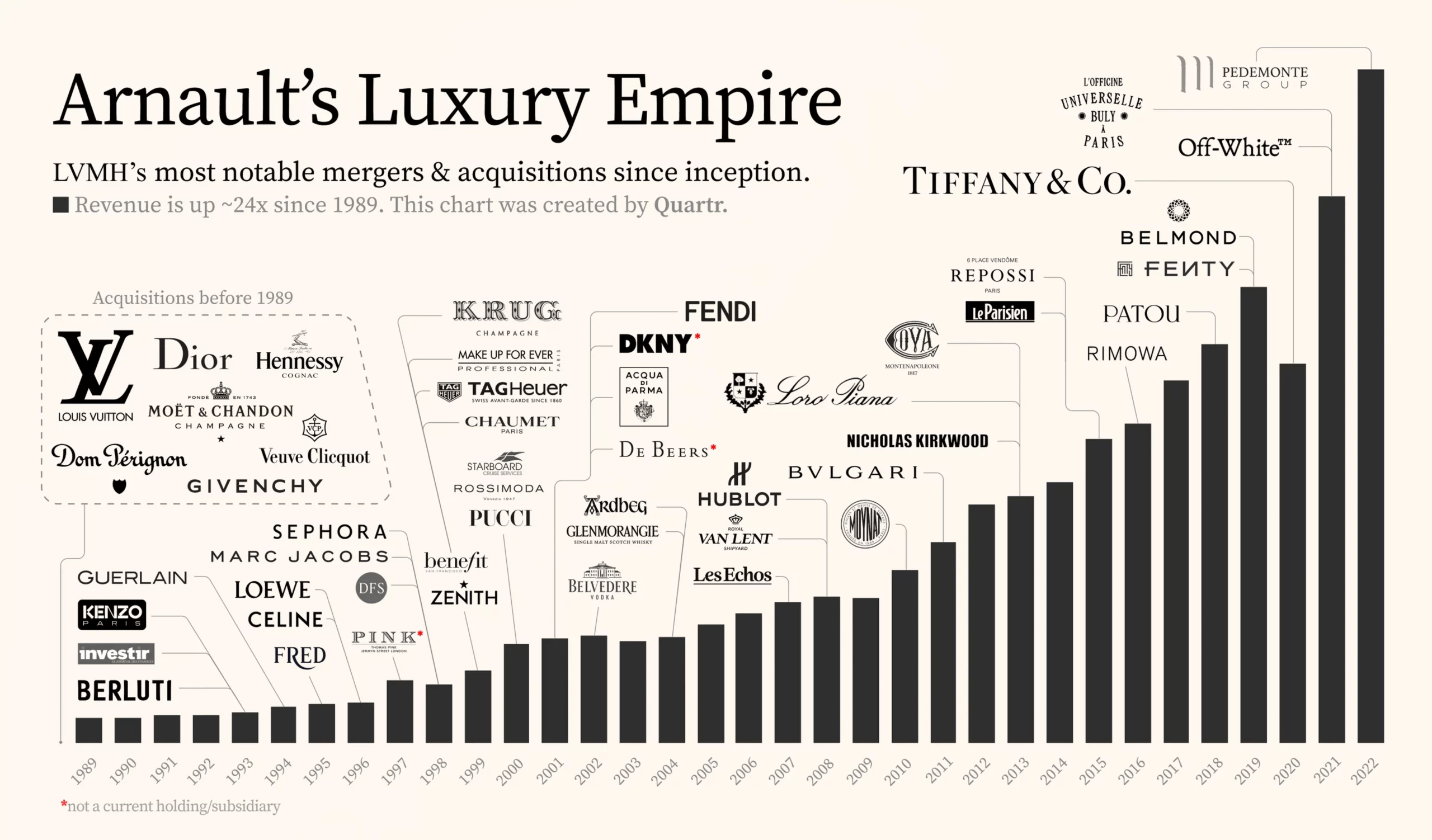

Crocs

People who love to hate Crocs had cause to celebrate in 2008 when investors were writing the company off as a passing fad. Crocs lost over $185 million that year and stock plunged to just over $1 a share from a high of about $69 a year earlier. But now they are back from the dead, sold 700 million pairs in the last decade, and have become a cultural icon. Crocs are a top brand among Gen Z. Limited edition Crocs are selling for up to $1,000 on the resale market.

From being written off as a fad to becoming a beloved brand with a cult following, Crocs’ growth story is a testament to strategic reinvention, market adaptation, and brand innovation. Here’s a detailed look at how Crocs drove growth over the years.

1. Innovative Product Design

Crocs began with a unique product design that set them apart in the footwear market. The original foam clog was comfortable, durable, and easy to clean, making it a hit among a diverse customer base, from healthcare workers to beachgoers. This initial innovation created a strong foundation for the brand’s growth.

2. Strategic Market Expansion

Early success in niche markets allowed Crocs to expand strategically. The company identified and targeted key demographics that valued comfort and functionality, including healthcare professionals, hospitality workers, and outdoor enthusiasts. By catering to specific needs within these segments, Crocs built a loyal customer base.

3. Cultural Resonance and Brand Revitalization

In 2008, Crocs faced significant financial challenges, with many writing off the brand as a passing fad. However, the company underwent a major revitalization, focusing on rebranding and marketing strategies that resonated with popular culture. Collaborations with high-profile designers and celebrities helped reposition Crocs as a trendy and fashionable choice. Limited edition releases and unique designs created buzz and demand in the market.

4. Leveraging Social Media and Influencer Marketing

Crocs effectively leveraged social media and influencer marketing to reconnect with younger audiences. Partnerships with influencers and celebrities, along with viral marketing campaigns, helped elevate the brand’s profile. This approach not only drove sales but also created a cultural phenomenon, turning Crocs into a fashion statement.

5. Product Diversification and Innovation

To sustain growth, Crocs diversified its product line beyond the classic clog. The introduction of new styles, including sandals, sneakers, and boots, appealed to a broader audience. Additionally, the brand invested in continuous innovation, enhancing the comfort and functionality of its products through new materials and technologies.

6. Focus on Sustainability

In recent years, Crocs has embraced sustainability as a core component of its growth strategy. The company committed to achieving a net-zero carbon footprint by 2030, incorporating eco-friendly materials and manufacturing processes. This focus on sustainability resonates with environmentally conscious consumers and strengthens the brand’s reputation.

7. Global Expansion

Crocs pursued aggressive global expansion to tap into international markets. By establishing a presence in key regions such as Asia, Europe, and Latin America, the company significantly broadened its customer base. Strategic partnerships and localized marketing efforts helped Crocs adapt to diverse cultural preferences and expand its global footprint.

8. Adaptability During Crises

Crocs demonstrated remarkable adaptability during the COVID-19 pandemic. Recognizing the increased demand for comfortable, home-friendly footwear, the company ramped up production and distribution. They also launched initiatives to support frontline workers, donating thousands of pairs to healthcare professionals, which enhanced brand loyalty and positive public perception.

9. Strong Financial Management

Effective financial management played a crucial role in Crocs’ growth. The company focused on cost optimization, efficient supply chain management, and maintaining healthy profit margins. Strategic investments in e-commerce and digital marketing also contributed to robust financial performance.

Crocs’ growth over the years is a compelling example of how a brand can reinvent itself through strategic innovation, cultural resonance, and adaptability. By staying true to its core values while continuously evolving to meet market demands, Crocs has transformed from a niche footwear brand into a global icon. The company’s journey highlights the importance of strategic planning, market adaptation, and brand innovation in driving sustainable growth.

Essilor Luxottica

Essilor Luxottica, a global leader in the design, manufacture, and distribution of eyewear, has achieved remarkable growth through a combination of strategic initiatives, innovation, and market expansion.

The Italian-French company is the global leader in the design, manufacture, and distribution of eyewear. It licenses many leading brands to develop premium eyewear, including Ray-Ban, Oakley, Costa, Vogue Eyewear, and Persol. It offers superior shopping and patient experiences with a network of 18,000 stores, including world-class retail brands like Sunglass Hut, LensCrafters, Salmoiraghi & Viganò, and GrandVision. Here’s a detailed look at how the company drove growth over the years:

1. Strategic Mergers and Acquisitions

Formation through Merger:

The merger of Essilor and Luxottica in 2018 created a powerhouse in the eyewear industry. This strategic move combined Essilor’s strength in lens technology with Luxottica’s expertise in frame design and retail, creating a vertically integrated company with a comprehensive portfolio of products and services.

Acquisitions to Expand Market Presence:

Over the years, Essilor Luxottica has acquired several companies to expand its market presence and product offerings. Notable acquisitions include:

- Ray-Ban: Luxottica’s acquisition of Ray-Ban in 1999 brought a globally recognized brand into its portfolio.

- Oakley: Acquired in 2007, Oakley added a strong performance eyewear brand.

- GrandVision: The acquisition of GrandVision in 2019 expanded Essilor Luxottica’s retail network significantly, adding over 7,000 stores worldwide.

2. Innovation and Product Development

R&D Investments:

Essilor Luxottica has consistently invested in research and development to drive innovation in eyewear. This has led to the development of advanced lens technologies such as:

- Varilux: The first progressive lens introduced by Essilor.

- Transitions: Photochromic lenses that adjust to changing light conditions.

Product Diversification:

The company has expanded its product range to cater to various market segments, from luxury to sports eyewear. Brands like Ray-Ban, Oakley, Vogue Eyewear, and Persol ensure that Essilor Luxottica has offerings for different consumer preferences and price points.

3. Retail and Distribution Network Expansion

Global Retail Presence:

Essilor Luxottica operates a vast retail network, including iconic retail brands like Sunglass Hut, LensCrafters, and Pearle Vision. This extensive network ensures a strong market presence and accessibility for consumers.

Omnichannel Strategy:

Embracing an omnichannel strategy, Essilor Luxottica has integrated its physical retail stores with online platforms. This approach provides a seamless shopping experience, catering to the evolving preferences of modern consumers.

4. Partnerships and Licensing Agreements

Licensing High-End Brands:

The company has secured licensing agreements with numerous high-end fashion brands, allowing it to produce and sell eyewear under prestigious labels such as Chanel, Prada, and Versace. These partnerships enhance the company’s brand portfolio and attract a diverse customer base.

Collaborations with Tech Companies:

Collaborations with technology companies have enabled Essilor Luxottica to integrate cutting-edge technologies into its products. For instance, the partnership with Google to develop smart glasses combines Luxottica’s design expertise with Google’s technological innovation.

5. Focus on Emerging Markets

Market Penetration in Emerging Economies:

Essilor Luxottica has strategically expanded its presence in emerging markets such as China, India, and Brazil. By tapping into these high-growth regions, the company has been able to reach new customer segments and drive revenue growth.

Tailored Products for Local Markets:

Understanding the unique needs of different markets, Essilor Luxottica has tailored its product offerings to suit local preferences. This localized approach has helped the company gain a competitive edge in diverse markets.

6. Commitment to Corporate Social Responsibility (CSR)

Vision for Life Program:

Essilor Luxottica’s Vision for Life program aims to improve access to vision care worldwide. By partnering with local organizations and governments, the company has launched initiatives to provide eye care services and affordable eyewear to underserved communities.

Sustainability Efforts:

The company has also committed to sustainability through initiatives aimed at reducing its environmental footprint. This includes efforts to minimize waste, use sustainable materials, and promote eco-friendly practices across its operations.

Essilor Luxottica’s growth strategy is a multifaceted approach that leverages strategic mergers and acquisitions, innovation, retail expansion, partnerships, and a strong focus on emerging markets and CSR. By continuously evolving and adapting to market demands, Essilor Luxottica has maintained its position as a global leader in the eyewear industry, driving sustainable and profitable growth.

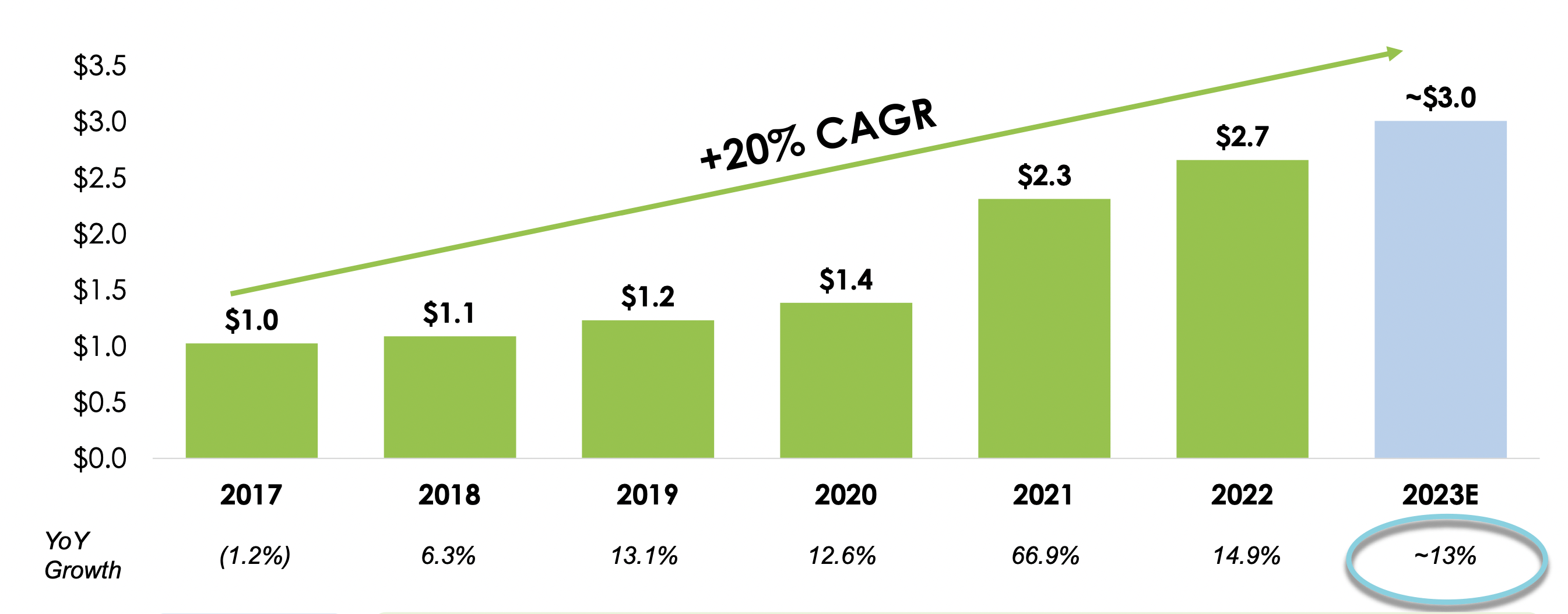

LVMH

LVMH, from Christian Dior to over 70 luxury brands, including Louis Vuitton and Givenchy, Sephora and Tiffany, has multiplied 20 times in market value under the leadership of Bernard Arnault.

In 1984 he spotted an opportunity to acquire a finance company that had lost its way but still owned some interesting assets, including Christian Dior and department store Le Bon Marche. He quickly set about refocusing the business and reenergizing its best assets for a changing world.

1. Strategic Acquisitions and Diversification

LVMH, under the leadership of Bernard Arnault, has driven growth through a series of strategic acquisitions. By acquiring a diverse range of luxury brands, LVMH has expanded its portfolio significantly. Key acquisitions include:

- Christian Dior: Acquiring this iconic fashion house provided a strong foundation in the luxury fashion segment.

- Louis Vuitton: Further solidified its presence in high fashion.

- Sephora: Expanded into the beauty retail sector.

- Tiffany & Co.: Strengthened its position in the luxury jewelry market.

These acquisitions have allowed LVMH to diversify its offerings and mitigate risks associated with reliance on a single brand or market segment.

2. Brand Rejuvenation and Synergies

LVMH excels at rejuvenating acquired brands and creating synergies between them. By investing in the marketing, innovation, and operations of these brands, LVMH has revitalized their market presence and enhanced their appeal. Synergies are created through shared services, cross-brand collaborations, and leveraging the group’s extensive retail network.

3. Focus on Innovation and Craftsmanship

Innovation is a cornerstone of LVMH’s growth strategy. The company invests heavily in research and development to create new products that align with market trends and consumer preferences. For instance, Louis Vuitton’s innovative designs and Dior’s cutting-edge fashion collections keep the brands at the forefront of the luxury market. Additionally, a strong emphasis on craftsmanship and quality ensures that LVMH products maintain their luxury status.

4. Expanding Global Footprint

LVMH has strategically expanded its global footprint, targeting emerging markets with growing affluent populations. Markets in Asia, particularly China, have been a significant focus. By opening flagship stores in major cities and leveraging local marketing strategies, LVMH has tapped into new customer bases and driven significant sales growth.

5. Digital Transformation and E-commerce

Recognizing the importance of digital channels, LVMH has embraced digital transformation. The company has developed robust e-commerce platforms for its brands, allowing customers to shop online seamlessly. Social media marketing and digital campaigns have also played a crucial role in reaching younger, tech-savvy consumers and enhancing brand visibility.

6. Customer Experience and Retail Excellence

LVMH prioritizes exceptional customer experiences, both online and offline. The company’s retail strategy involves creating luxurious, immersive shopping environments in its stores. Personalized services, exclusive events, and bespoke products enhance customer loyalty and brand prestige. In the digital realm, LVMH ensures that its e-commerce platforms offer user-friendly interfaces and premium services, such as fast shipping and easy returns.

7. Sustainability and Corporate Responsibility

Sustainability is increasingly important to luxury consumers, and LVMH has integrated sustainable practices into its operations. Initiatives include using environmentally friendly materials, reducing carbon emissions, and promoting ethical sourcing. These efforts not only align with consumer values but also strengthen LVMH’s brand image and long-term viability.

8. Leadership and Vision

Bernard Arnault’s visionary leadership has been instrumental in driving LVMH’s growth. His strategic foresight, willingness to take calculated risks, and ability to identify and capitalize on market opportunities have positioned LVMH as a global leader in the luxury industry. Arnault’s focus on maintaining the heritage and authenticity of each brand while driving innovation and growth has been a key factor in LVMH’s success.

Mercado Libre

Mercado Libre was founded in 1999 by Marcos Galperin and two colleagues while at Stanford University. Their vision was to create an online marketplace that would democratize commerce and financial services in Latin America. This vision laid the foundation for the company’s strategic direction and growth.

Mercado Libre is on a mission “to democratize commerce and financial services to transform the lives of millions of people in Latin America”. It hosts the largest online commerce and payments ecosystem in Latin America and operates in 18 countries, although Brazil alone accounts for 65% of its revenue, growing to 96% when including Argentina and Mexico. MELI was founded in 1999 by Marcos Galperin and two colleagues while at Stanford.

1. Key Strategies for Growth

Marketplace Expansion

Mercado Libre initially focused on creating a robust online marketplace. They provided a platform where individuals and businesses could buy and sell a wide range of products. This marketplace model was crucial in driving early growth by attracting a diverse user base and increasing transaction volumes.

Payment Solutions

Recognizing the challenges of financial transactions in Latin America, Mercado Libre launched Mercado Pago in 2004. This payment solution facilitated secure online payments, addressing a significant barrier to e-commerce in the region. By providing a reliable payment gateway, Mercado Pago enhanced user trust and convenience, driving more transactions on the platform.

Logistics and Fulfillment

To improve delivery times and customer satisfaction, Mercado Libre invested heavily in logistics and fulfillment services. They launched Mercado Envíos, a logistics solution that streamlined shipping and delivery processes. By optimizing logistics, the company could offer faster and more reliable delivery services, enhancing the overall shopping experience.

Mobile Strategy

As mobile internet penetration increased, Mercado Libre adapted by focusing on mobile-friendly platforms. They developed mobile apps that provided seamless shopping experiences on smartphones. This strategic shift capitalized on the growing number of mobile users in Latin America, significantly boosting user engagement and transactions.

Geographic Expansion

Mercado Libre expanded its operations across Latin America, entering key markets such as Brazil, Argentina, Mexico, and Chile. Brazil, in particular, became a significant revenue driver, accounting for a substantial portion of the company’s total revenue. This geographic diversification helped mitigate risks and capture growth opportunities in different markets.

Financial Services Expansion

Building on the success of Mercado Pago, Mercado Libre expanded its financial services portfolio. They introduced Mercado Crédito, which provided credit lines to sellers and buyers on the platform. By offering financial solutions, Mercado Libre enabled more transactions and supported small businesses, fostering growth within their ecosystem.

Innovation and Technology

Innovation has been a cornerstone of Mercado Libre’s growth strategy. The company continuously invests in technology to enhance platform functionality, user experience, and security. Implementing AI and machine learning has improved product recommendations, search results, and fraud detection, further driving user engagement and trust.

2. Strategic Partnerships and Acquisitions

Partnerships

Mercado Libre formed strategic partnerships with various companies to enhance its services. Collaborations with logistics firms, payment processors, and technology providers have strengthened their operational capabilities and expanded their service offerings.

Acquisitions

To accelerate growth and expand its market presence, Mercado Libre pursued strategic acquisitions. For example, the acquisition of companies like KPL, a leading Brazilian online retailer, helped Mercado Libre strengthen its position in key markets and integrate new technologies and capabilities into its platform.

3. Fostering a Strong Brand and Community

Brand Trust and Recognition

Mercado Libre focused on building a strong, trustworthy brand. Through consistent service quality, secure transactions, and reliable customer support, the company earned the trust of millions of users across Latin America. A strong brand reputation has been instrumental in attracting and retaining customers.

Community Building

Mercado Libre actively engaged with its user community, fostering a sense of belonging and loyalty. They provided educational resources, seller support programs, and community forums to help users succeed on the platform. This community-centric approach enhanced user satisfaction and loyalty.

4. Financial Performance and Market Leadership

Mercado Libre’s strategic initiatives have translated into impressive financial performance. The company consistently reports strong revenue growth, driven by increasing transaction volumes, expanding user base, and diversified revenue streams. Today, Mercado Libre is the largest online commerce and payments ecosystem in Latin America, operating in 18 countries and serving millions of users.

Mercado Libre’s growth story is a testament to strategic vision, innovation, and execution. By focusing on marketplace expansion, payment solutions, logistics, mobile strategy, geographic expansion, financial services, and strategic partnerships, the company has successfully driven and sustained growth over the years. Mercado Libre’s journey underscores the importance of adapting to market dynamics, investing in technology, and maintaining a customer-centric approach in achieving long-term success.

Nubank

Nubank launched in 2013 with the mission to fight complexity and empower people in their daily lives by reinventing financial services. Its first product was a credit card that differentiated itself by not charging traditional fees, such as annual fees or over-limit fees, and all based in a digital app.

Nubank is now one of the world’s largest digital banking platforms, serving more than 80 million customers across Brazil, Mexico, and Colombia.

1. Customer-Centric Approach

Understanding Customer Pain Points

Nubank started by identifying the significant pain points faced by traditional bank customers in Brazil, such as high fees, poor customer service, and cumbersome processes. By addressing these issues, Nubank positioned itself as a customer-friendly alternative.

No-Fee Credit Card

Nubank’s first product was a no-fee credit card managed entirely through a digital app. This innovative approach eliminated traditional banking fees and offered a transparent, user-friendly experience. The no-fee model resonated with customers frustrated by the hidden costs and complexities of conventional banks.

Digital-First Experience

The entirely digital nature of Nubank’s services allowed for a seamless and efficient user experience. Customers could manage their finances, request support, and perform transactions through a mobile app, which provided convenience and accessibility, particularly appealing to tech-savvy consumers.

2. Leveraging Technology

Scalable Tech Infrastructure

Nubank invested heavily in building a robust and scalable technology infrastructure. This investment enabled the company to handle rapid growth and scale its operations efficiently while maintaining high service quality and reliability.

Data-Driven Decision Making

By leveraging data analytics, Nubank gained deep insights into customer behavior and preferences. This data-driven approach allowed Nubank to continually refine its products and services, enhancing customer satisfaction and loyalty.

Innovative Features

Nubank continuously introduced innovative features and services, such as real-time transaction notifications, easy-to-use budgeting tools, and seamless integration with other financial services. These features enhanced the overall customer experience and set Nubank apart from traditional banks.

3. Expanding Product Portfolio

Personal Loans and Business Accounts

Building on the success of its credit card, Nubank expanded its product portfolio to include personal loans and business accounts. This diversification allowed Nubank to cater to a broader customer base and increase its market share.

NuConta

Nubank launched NuConta, a digital payment account offering customers features like instant payments, free transfers, and interest on account balances. NuConta provided an alternative to traditional checking accounts, further driving customer acquisition and engagement.

4. Strategic Market Expansion

Geographic Expansion

After establishing a strong presence in Brazil, Nubank expanded into other Latin American markets, including Mexico and Colombia. This geographic diversification helped Nubank tap into new customer segments and reduce its reliance on a single market.

Localized Offerings

Nubank tailored its products and services to meet the specific needs of each market it entered. By understanding and addressing local banking challenges, Nubank was able to offer relevant solutions that resonated with customers in each region.

5. Strong Brand and Community Engagement

Brand Trust and Loyalty

Nubank’s commitment to transparency, customer service, and innovation built strong brand trust and loyalty. Customers viewed Nubank as a trustworthy and reliable financial partner, which drove word-of-mouth referrals and organic growth.

Community and Social Media Engagement

Nubank actively engaged with its customer community through social media and other digital platforms. This engagement helped build a strong community of brand advocates who promoted Nubank’s services and contributed to its growth.

6. Effective Fundraising and Financial Management

Securing Investment

Nubank successfully secured significant investment from global investors, including Sequoia Capital, Tencent, and DST Global. This funding enabled Nubank to invest in technology, expand its product offerings, and support its growth initiatives.

Efficient Cost Management

By operating as a digital-only bank, Nubank significantly reduced operational costs associated with physical branches. This cost efficiency allowed Nubank to offer competitive pricing and reinvest savings into customer-centric innovations.

7. Commitment to Social Impact

Financial Inclusion

Nubank focused on promoting financial inclusion by providing accessible banking services to underserved populations. This commitment to social impact not only drove customer growth but also enhanced Nubank’s reputation as a socially responsible company.

Sustainability Initiatives

Nubank implemented various sustainability initiatives, such as environmentally friendly credit cards and digital statements. These efforts resonated with eco-conscious consumers and reinforced Nubank’s commitment to positive social and environmental impact.

Nubank’s growth journey is a testament to the power of innovation, customer-centricity, and strategic expansion. By addressing customer pain points, leveraging technology, diversifying its product portfolio, and maintaining a strong brand presence, Nubank has transformed the financial landscape in Latin America and established itself as a leader in digital banking. Its commitment to financial inclusion and sustainability further underscores its role as a forward-thinking and socially responsible company.

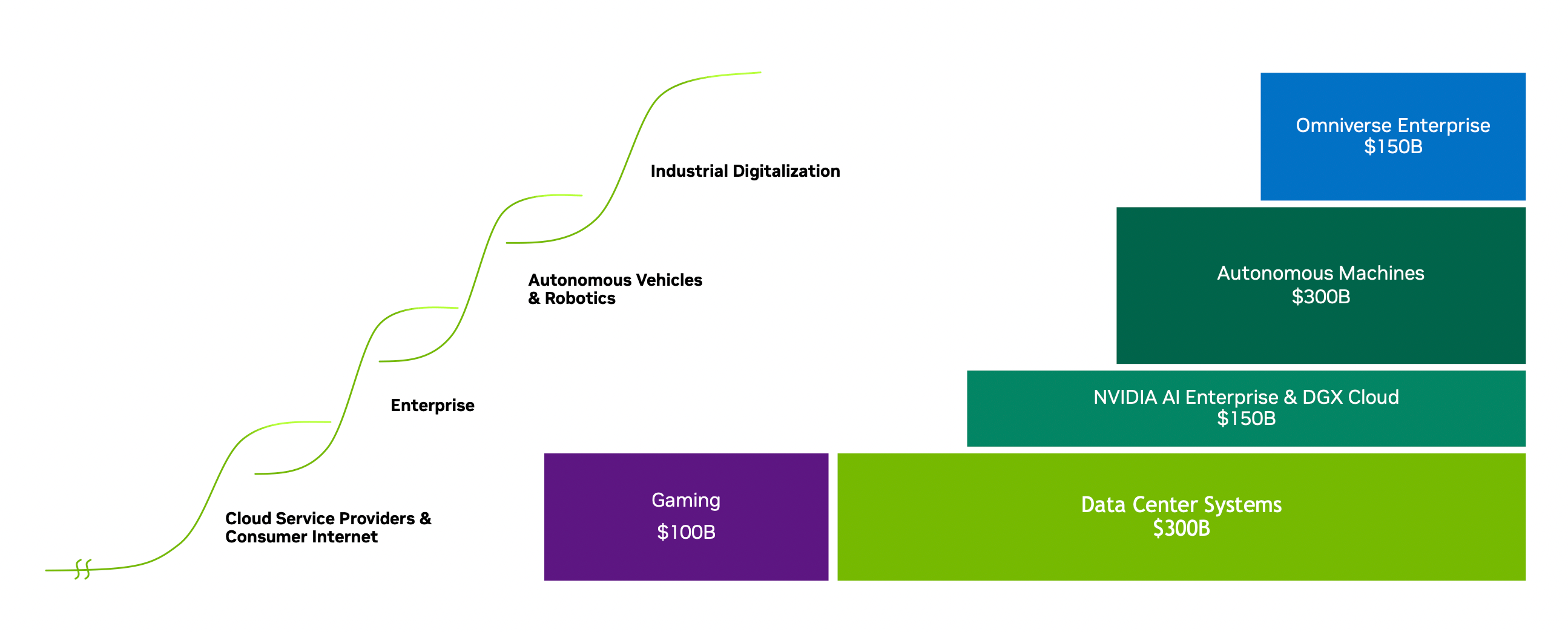

Nvidia

AI is transforming our world. The software that enables computers to do things that once required human perception and judgment depends largely on hardware made possible by Jensen Huang, who co-founded Nvidia in 1993.

In 2024, Nvidia’s earnings are forecast to increase at a compound annual growth rate of 103% over the next five years. That would be more than double the 48% CAGR Nvidia’s bottom line has clocked in the past five years.

1. Pioneering Graphics Technology

Nvidia was founded in 1993 with a focus on high-performance graphics technology. Its breakthrough came in 1999 with the launch of the GeForce 256, the world’s first GPU. This innovation transformed the gaming industry, providing unprecedented graphics quality and performance. By continuously improving GPU technology, Nvidia established itself as a leader in the gaming market.

2. Expansion into New Markets

Recognizing the potential of its GPU technology beyond gaming, Nvidia expanded into new markets:

Professional Visualization: Nvidia’s Quadro GPUs became the standard for professionals in industries such as film, animation, and design.

Data Centers and AI: Nvidia capitalized on the rise of artificial intelligence and machine learning by developing GPUs optimized for data centers and AI workloads. The launch of the Tesla and later the A100 GPUs made Nvidia a key player in the AI revolution.

Automotive: Nvidia entered the automotive market with its DRIVE platform, providing AI and deep learning capabilities for autonomous vehicles.

3. Strategic Partnerships and Acquisitions

Nvidia’s growth strategy included forming strategic partnerships and making key acquisitions:

Partnerships: Collaborations with major technology companies, research institutions, and universities helped Nvidia integrate its technology into a wide range of applications and industries.

Acquisitions: Nvidia acquired companies such as Mellanox Technologies, enhancing its capabilities in high-performance computing and networking.

4. Development of CUDA Platform

In 2006, Nvidia launched CUDA (Compute Unified Device Architecture), a parallel computing platform and programming model. CUDA enabled developers to leverage the power of GPUs for general-purpose computing, opening up new possibilities in scientific research, simulations, and deep learning. This innovation broadened Nvidia’s market beyond graphics to include scientific and enterprise applications.

5. Focus on Research and Development

Nvidia consistently invested a significant portion of its revenue into research and development (R&D). This commitment to R&D ensured that Nvidia stayed at the forefront of technological advancements and continued to innovate in GPU architecture, software, and AI capabilities.

6. Visionary Leadership

Jensen Huang, Nvidia’s co-founder and CEO, played a crucial role in driving the company’s growth. His vision for the future of computing, emphasis on innovation, and ability to identify emerging trends positioned Nvidia as a leader in multiple industries. Under his leadership, Nvidia navigated market shifts and expanded its influence.

7. Adapting to Industry Trends

Nvidia’s ability to adapt to industry trends and shifts in technology demand was a key factor in its growth:

AI and Deep Learning: As AI and deep learning gained prominence, Nvidia’s GPUs became essential for training complex neural networks. The company’s early investment in AI research paid off as demand for AI processing power surged.

Edge Computing and IoT: Nvidia addressed the growing need for edge computing and the Internet of Things (IoT) by developing smaller, energy-efficient GPUs suitable for deployment in edge devices.

8. Building a Strong Ecosystem

Nvidia built a robust ecosystem of developers, researchers, and industry partners. The Nvidia Developer Program, GPU Technology Conference (GTC), and extensive documentation and support helped foster a vibrant community that drove innovation and adoption of Nvidia’s technology.

9. Financial Performance and Market Strategy

Nvidia’s financial strategy included prudent management of resources, strategic investments, and a focus on long-term growth. The company’s strong financial performance allowed it to reinvest in key growth areas, acquire complementary businesses, and expand its global reach.

Through a combination of technological innovation, market diversification, strategic partnerships, and visionary leadership, Nvidia successfully drove and sustained its growth over the years. The company’s ability to adapt to new opportunities and maintain its leadership in key markets has cemented its position as a tech industry powerhouse.

On

Olivier Bernhard is on a mission to “ignite the human spirit through movement” and to make Swiss brand On “the most premium global sportswear brand”. The former triathlete devoted himself to finding a running shoe that would give him the perfect running sensation. In doing so, he crossed paths with a like-minded Swiss engineer who had an idea for a new kind of running shoe.

Founded in 2010 by former professional athlete Olivier Bernhard and his friends David Allemann and Caspar Coppetti, On has evolved from a small startup into a global brand known for its innovative running shoes and sportswear. The company’s journey is a testament to the power of innovation, customer-centricity, and strategic expansion.

1. Innovation at the Core: Revolutionizing Running Shoes

At the heart of On’s growth is its relentless focus on innovation. Olivier Bernhard’s quest for the perfect running sensation led to the development of On’s unique CloudTec technology. This cushioning system, designed to provide a soft landing followed by an explosive take-off, set On’s shoes apart from traditional running footwear. By continuously improving and expanding its product range, On has maintained its competitive edge and attracted a loyal customer base.

2. Customer-Centric Approach: Listening and Adapting

On’s growth has been fueled by a strong commitment to understanding and meeting the needs of its customers. The company actively seeks feedback from runners and athletes to refine its products and develop new features. This customer-centric approach has resulted in high levels of satisfaction and brand loyalty, driving repeat purchases and positive word-of-mouth referrals.

3. Strategic Partnerships and Collaborations

To expand its reach and enhance its brand appeal, On has formed strategic partnerships and collaborations with various organizations and influencers. These partnerships have helped On tap into new markets and gain exposure to diverse customer segments. Collaborations with high-profile athletes and fitness influencers have also boosted On’s credibility and visibility in the sportswear market.

4. Expanding Product Lines: Beyond Running Shoes

While On initially focused on running shoes, the company has strategically expanded its product lines to include a wide range of sportswear and accessories. This diversification has allowed On to cater to a broader audience and capitalize on the growing demand for high-performance sportswear. By offering a complete athletic apparel solution, On has increased its market share and revenue streams.

5. Entering New Markets: Global Expansion

On’s growth strategy includes a strong emphasis on international expansion. The company has successfully entered key markets in Europe, North America, and Asia, establishing a global presence. On has tailored its marketing and distribution strategies to suit the unique preferences and needs of each market, ensuring a localized and effective approach to growth.

6. Sustainability and Social Responsibility

On’s commitment to sustainability has also played a significant role in its growth. The company has introduced environmentally friendly practices in its manufacturing processes and launched products made from recycled materials. By aligning its growth strategy with sustainability goals, On has appealed to eco-conscious consumers and strengthened its brand reputation.

7. Leveraging Technology and Digital Marketing

On has effectively leveraged technology and digital marketing to drive growth. The company’s robust online presence, including an intuitive e-commerce platform and engaging social media channels, has facilitated direct-to-consumer sales and enhanced customer engagement. On’s use of data analytics and digital marketing tools has enabled it to target customers more effectively and optimize its marketing campaigns.

On’s journey from a niche startup to a global sportswear brand offers valuable lessons in driving growth. By prioritizing innovation, maintaining a customer-centric approach, forming strategic partnerships, expanding product lines, entering new markets, committing to sustainability, and leveraging technology, On has built a strong foundation for sustained success. The company’s ability to adapt and evolve in response to changing market dynamics ensures that it will continue to thrive in the competitive sportswear industry.

Ping An

Ping An is the world’s largest insurance business, and more generally provides products and services through its five ecosystems in financial services, healthcare, auto services, real estate services, and smart city solutions.

The company’s first steps beyond finance started in 2012. Co-CEO Jessica Tan has developed a vision of “technology plus finance” as key to Ping An’s ongoing growth, most notably with Good Doctor as the world’s leading digital healthcare platform.

1. Diversified Business Model

Ping An’s business model is highly diversified, spanning multiple sectors including insurance, banking, asset management, and technology. This diversification has not only spread risk but also created multiple revenue streams, enhancing stability and growth potential. Key segments include:

- Insurance: Ping An is one of the world’s largest insurers, with significant market share in life and health insurance in China.

- Banking: Ping An Bank provides a wide range of banking services, focusing on retail and corporate banking.

- Asset Management: Ping An Asset Management offers investment management services, enhancing returns on its extensive portfolio.

2. Technological Innovation

A cornerstone of Ping An’s strategy has been its relentless focus on technology and innovation. The company has invested heavily in fintech and healthtech, establishing itself as a leader in digital transformation. Highlights include:

- AI and Big Data: Ping An has leveraged artificial intelligence and big data analytics to enhance its underwriting processes, improve customer service, and streamline operations. For instance, its AI-driven underwriting system has significantly reduced processing times and improved risk assessment accuracy.

- Smart Healthcare: Through its Good Doctor platform, Ping An has revolutionized healthcare in China, offering telemedicine, online consultations, and health management services. This platform has expanded healthcare access and improved service efficiency.

3. Ecosystem Strategy

Ping An has developed a comprehensive ecosystem strategy, integrating its various business units to create synergies and enhance customer value. This ecosystem includes:

- Financial Services: Seamlessly connecting insurance, banking, and investment services through digital platforms.

- Smart City Solutions: Leveraging technology to provide smart city solutions, including smart traffic management, environmental monitoring, and public safety services.

4. Customer-Centric Approach

Ping An has placed a strong emphasis on understanding and meeting customer needs, which has been central to its growth strategy. Key aspects include:

- Personalized Services: Utilizing big data and AI to offer personalized financial and healthcare services, enhancing customer satisfaction and loyalty.

- Innovative Products: Developing innovative products such as the “Ping An One Account,” which integrates multiple financial services into a single platform, simplifying customer interactions.

5. Strategic Partnerships and Acquisitions

To accelerate growth and expand its market presence, Ping An has pursued strategic partnerships and acquisitions. These moves have enhanced its capabilities and broadened its service offerings:

- Acquisitions: Ping An has acquired several fintech startups and technology firms, boosting its technological edge and market reach. For example, its acquisition of Lufax, a leading online wealth management platform, has strengthened its asset management capabilities.

- Partnerships: Collaborating with global technology firms and financial institutions to enhance its technological infrastructure and service offerings.

6. Regulatory Navigation and Compliance

Ping An has adeptly navigated regulatory landscapes, ensuring compliance while pursuing growth opportunities. This strategic compliance has allowed it to expand its operations smoothly and avoid regulatory pitfalls.

7. Global Expansion

Beyond China, Ping An has also focused on expanding its footprint internationally. It has invested in international markets, establishing a presence in key global financial hubs and exploring new growth opportunities in emerging markets.

Ping An’s growth strategy is a testament to its vision, innovation, and adaptability. By integrating technology, fostering a diversified business model, and maintaining a strong customer focus, Ping An has not only grown significantly but also set new benchmarks in the global financial services industry. The company’s journey underscores the importance of strategic foresight, technological adoption, and customer-centric innovation in driving sustainable growth.

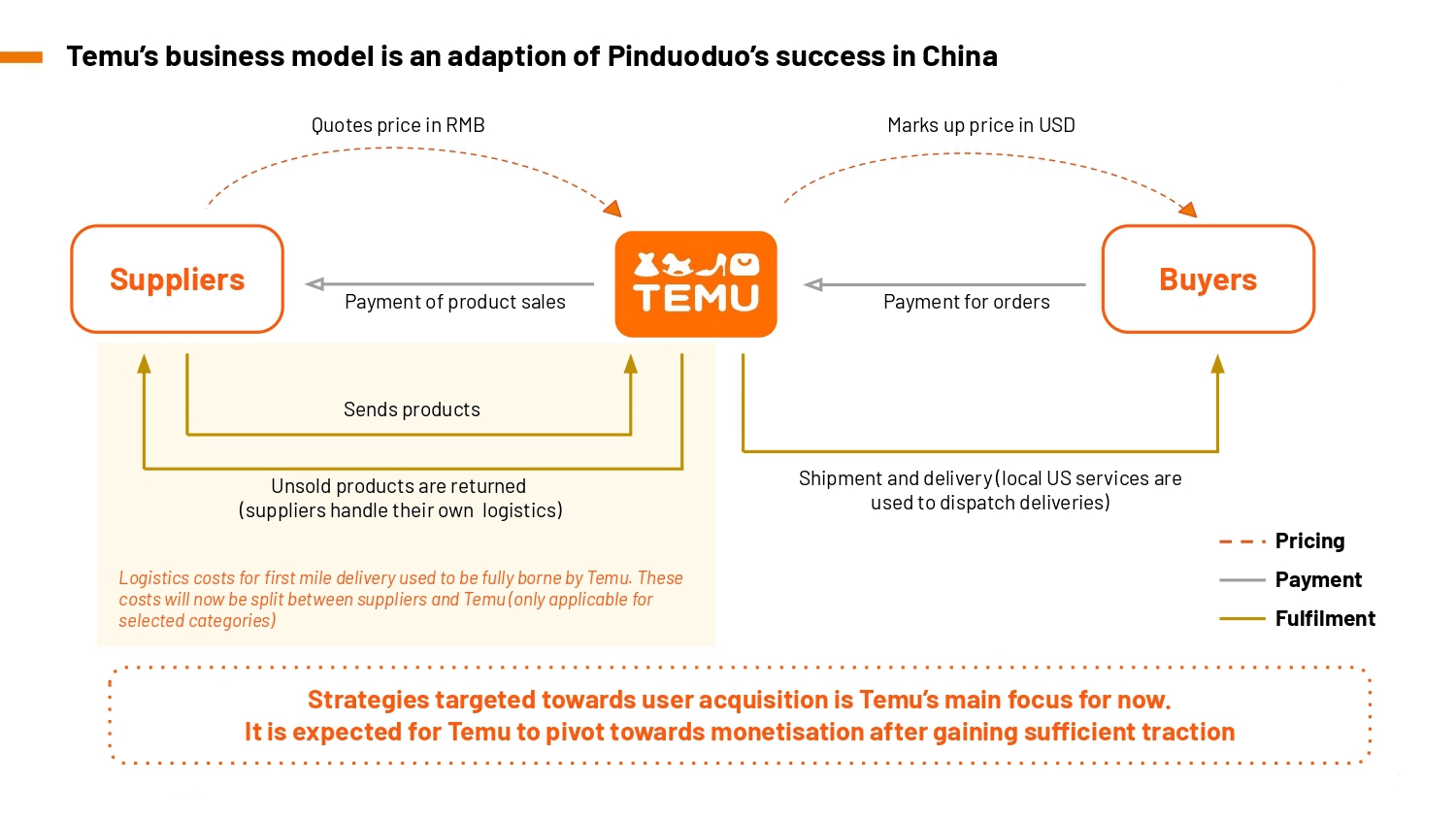

Temu

The Pinduoduo-owned online fashion retail platform burst into western markets in September 2022, and immediately outperformed the similar Shein business, and has continued to gain more visitors than Amazon. While Chinese-owned, Temu is a US-registered company, based in Boston, USA.

Temu’s focus is on super-cheap, super-fast, medium-quality fashion, using an on-demand super-fast business model. Sales are driven by social media, live-streaming, relentless offers, and gamification.

1. Leveraging Parent Company’s Ecosystem

Temu capitalized on the extensive resources and experience of its parent company, Pinduoduo. By leveraging Pinduoduo’s advanced supply chain logistics, Temu was able to ensure efficient operations and cost management. This support enabled Temu to scale quickly and handle large volumes of transactions effectively.

2. Aggressive Market Entry and Expansion

Temu’s entry into the Western markets was marked by an aggressive expansion strategy. The company launched in September 2022 and quickly captured significant market share by outperforming established competitors like Shein. Temu’s rapid growth in new markets was driven by its ability to offer highly competitive prices and fast delivery times, appealing to cost-conscious consumers.

3. On-Demand Business Model

Temu adopted an on-demand business model that focuses on providing super-cheap, super-fast, and medium-quality fashion products. This model allowed Temu to meet the immediate needs of its customers efficiently, contributing to high customer satisfaction and repeat purchases. The on-demand approach also minimized inventory costs and reduced the risk of overproduction.

4. Social Media and Digital Marketing

A key driver of Temu’s growth has been its effective use of social media and digital marketing. The company employed a multi-channel marketing strategy, utilizing platforms like Instagram, TikTok, and Facebook to reach its target audience. Temu’s marketing campaigns often featured influencers and live-streaming events, creating a buzz and driving traffic to their platform.

5. Gamification and Relentless Offers

Temu’s platform incorporates elements of gamification to engage users and encourage frequent interaction. By offering daily deals, flash sales, and interactive games, Temu kept users engaged and motivated to return regularly. This strategy not only boosted sales but also enhanced customer loyalty.

6. Focus on Customer Experience

Temu placed a strong emphasis on delivering an exceptional customer experience. This included easy-to-navigate website and app interfaces, responsive customer service, and a hassle-free return policy. By prioritizing customer satisfaction, Temu was able to build a strong brand reputation and foster long-term relationships with its customers.

7. Data-Driven Decision Making

Temu leveraged advanced data analytics to understand customer preferences and market trends. By analyzing data on purchasing behavior, product performance, and customer feedback, Temu was able to make informed decisions about product offerings, pricing strategies, and marketing campaigns. This data-driven approach ensured that the company remained agile and responsive to market demands.

8. Strategic Partnerships and Collaborations

To enhance its product offerings and market reach, Temu formed strategic partnerships with various brands and suppliers. These collaborations allowed Temu to offer a wide range of products at competitive prices, attracting a diverse customer base. The partnerships also enabled Temu to expand its product categories and meet the evolving needs of its customers.

9. Commitment to Innovation

Innovation has been at the core of Temu’s growth strategy. The company continuously explored new technologies and business models to stay ahead of the competition. From integrating AI-driven personalization features to experimenting with new retail formats, Temu’s commitment to innovation ensured that it remained a dynamic and forward-thinking player in the e-commerce space.

10. Building a Strong Brand Identity

Despite being a relatively new player in the market, Temu invested heavily in building a strong brand identity. The company’s branding efforts focused on conveying value, reliability, and customer-centricity. Through consistent branding across all touchpoints, Temu established a recognizable and trusted brand that resonated with consumers.

By implementing these strategies, Temu successfully drove growth and established itself as a formidable competitor in the global e-commerce market. The company’s ability to adapt to changing market conditions, leverage technology, and prioritize customer satisfaction has been instrumental in its rapid ascent.

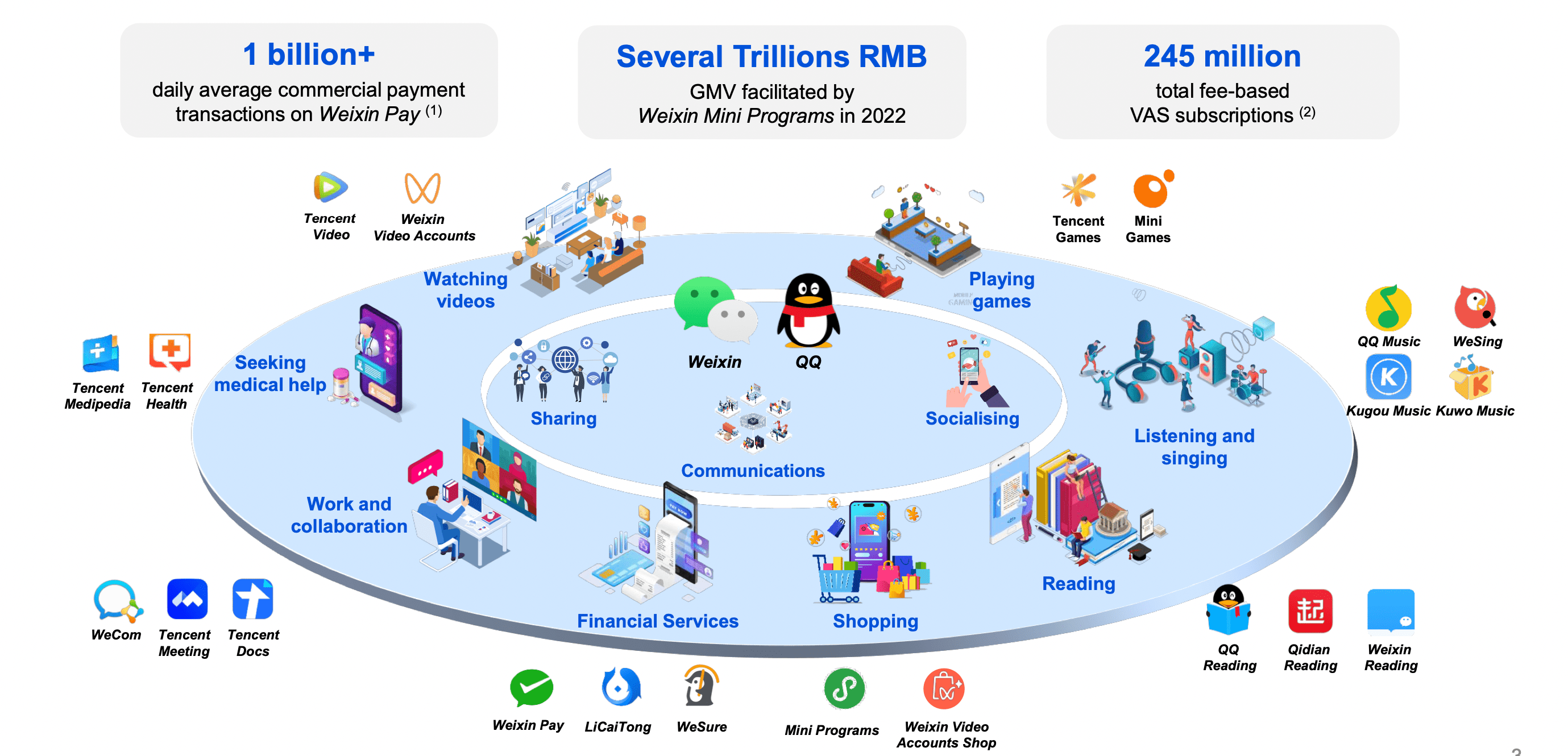

Tencent

Tencent is a tech ecosystem, with a purpose “Value for Users, Tech for Good”. Its social platforms WeChat (known as Weixin in China) and QQ connect users with each other, with digital content and daily life services in just a few clicks. It was founded in 1998 by Ma Huateng, known as Pony Ma, in Shenzhen. Launched in 2011, WeChat has grown into the most popular and widely used mobile app globally and serves as a central part of daily life for its many users in China and beyond.

Here are the key elements that have fueled Tencent’s remarkable growth over the years:

1. Diversification of Services

Tencent started as an instant messaging service with the launch of QQ in 1998. Recognizing the potential for digital ecosystems, the company expanded into various segments, including social media, gaming, fintech, cloud services, and entertainment. This diversification helped Tencent build a robust and interconnected portfolio of services that cater to various aspects of digital life.

- Social Media: WeChat, launched in 2011, became a super-app integrating messaging, social media, mobile payments, and more, making it indispensable for millions of users.

- Gaming: Tencent is the world’s largest video game vendor, with significant investments in popular games and gaming companies, including Riot Games, Epic Games, and Supercell.

2. Strategic Acquisitions and Investments

Tencent has pursued a strategy of strategic acquisitions and investments to expand its market presence and capabilities. By investing in both domestic and international companies, Tencent has broadened its technological expertise and market reach.

- Gaming Investments: Acquisitions like Riot Games (developer of League of Legends) and stakes in companies like Epic Games (developer of Fortnite) have solidified Tencent’s position in the gaming industry.

- Technology Startups: Investments in promising startups across various sectors, including AI, fintech, and e-commerce, have helped Tencent stay at the forefront of technological innovation.

3. Building a Comprehensive Ecosystem

Tencent has built a comprehensive digital ecosystem that integrates various services, making it a central part of users’ daily lives. This ecosystem approach ensures that users remain engaged within the Tencent platform, increasing user retention and generating multiple revenue streams.

- WeChat Ecosystem: WeChat’s ecosystem includes mini-programs, WeChat Pay, WeChat Work, and more, offering a wide range of services within a single app.

- Entertainment and Media: Tencent Video, QQ Music, and Tencent Pictures provide extensive content offerings, enhancing user engagement across different media formats.

4. Innovative Product Development

Innovation has been a cornerstone of Tencent’s growth. The company continuously develops new products and features to enhance user experience and stay ahead of the competition.

- WeChat Pay: Revolutionized mobile payments in China, integrating seamlessly into the WeChat ecosystem and becoming a preferred payment method for millions.

- Cloud Services: Tencent Cloud offers robust cloud computing services, catering to enterprises and startups alike, driving growth in the cloud computing market.

5. User-Centric Approach

Tencent places a strong emphasis on understanding and meeting user needs. This user-centric approach has helped the company develop products that resonate deeply with users, driving high levels of engagement and loyalty.

- Customization and Personalization: Tencent’s platforms offer personalized content and services, enhancing user satisfaction and retention.

- User Feedback: Actively incorporating user feedback into product development ensures that Tencent’s offerings remain relevant and user-friendly.

6. Global Expansion

While Tencent’s primary market is China, the company has strategically expanded its presence globally through acquisitions, partnerships, and investments. This global expansion has opened up new growth opportunities and diversified Tencent’s revenue streams.

- International Gaming Market: Tencent’s investments in international gaming companies have extended its influence and revenue potential beyond China.

- Strategic Partnerships: Collaborations with international firms in technology and entertainment sectors have helped Tencent penetrate new markets and enhance its global footprint.

7. Monetization Strategies

Tencent employs diverse monetization strategies to maximize revenue from its wide array of services. These strategies include in-app purchases, advertising, subscription services, and more.

- Gaming Revenue: A significant portion of Tencent’s revenue comes from in-game purchases and subscriptions within its gaming portfolio.

- Advertising: Tencent’s social media platforms and digital content services provide valuable advertising space, generating substantial ad revenue.

8. Commitment to Innovation in Technology

Tencent has consistently invested in cutting-edge technologies such as artificial intelligence, big data, and cloud computing. These investments have not only enhanced Tencent’s existing services but also positioned the company as a leader in tech innovation.

- AI Research: Tencent AI Lab focuses on advancing AI technologies and applying them across various sectors, including healthcare, finance, and autonomous driving.

- Cloud Computing: Tencent Cloud has grown rapidly, offering scalable and secure cloud solutions to businesses worldwide.

Tencent’s growth over the years can be attributed to its strategic diversification, innovative product development, user-centric approach, and aggressive expansion through acquisitions and investments. By building a comprehensive ecosystem and continuously evolving to meet market demands, Tencent has established itself as a dominant force in the global technology landscape.

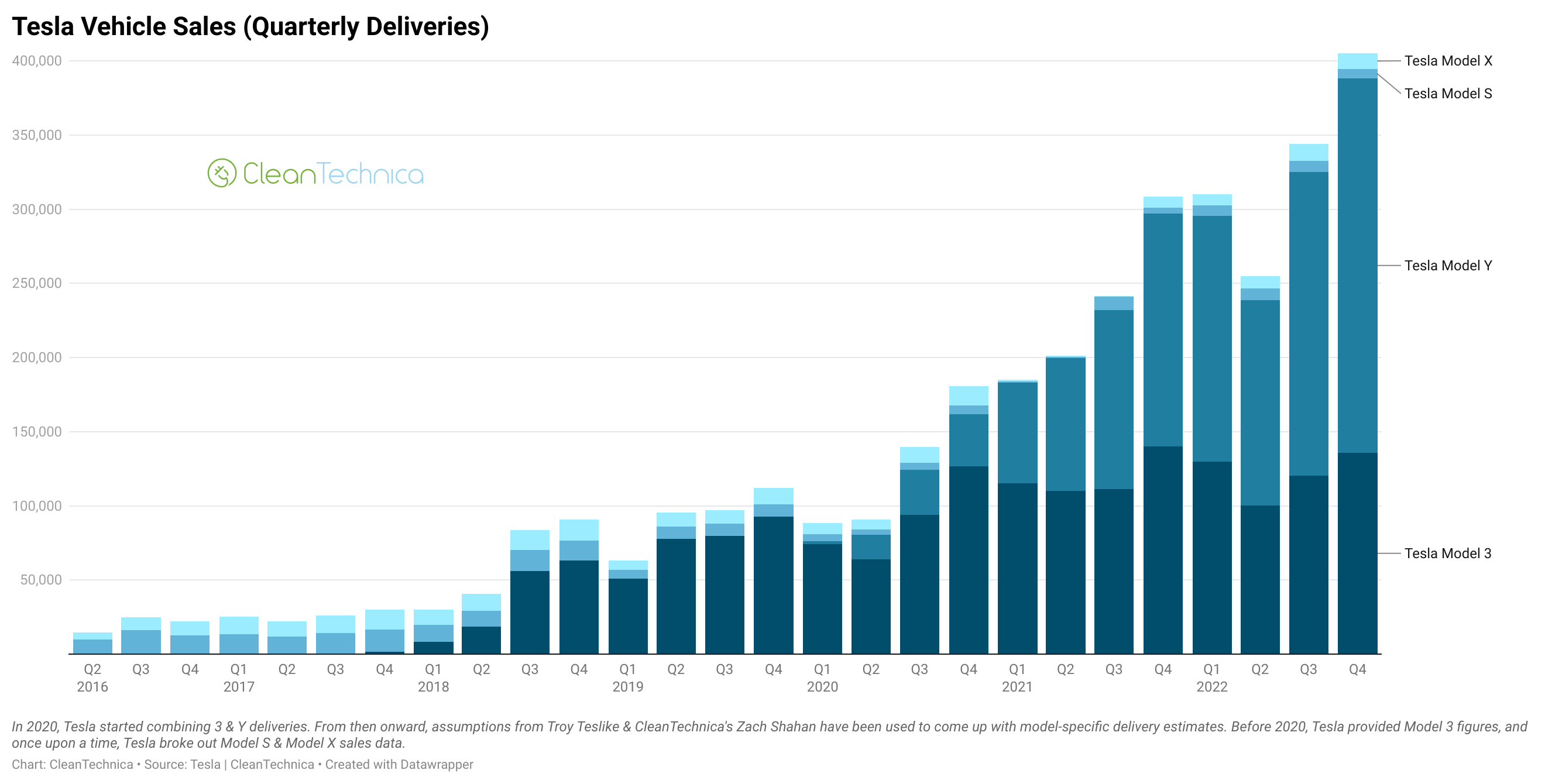

Tesla

Faster than a Ferrari, powered by the sun. Tesla was founded in 2004 “to accelerate the world’s transition to sustainable energy”. Elon Musk took over as CEO in 2008 and achieved profitability in 2013.

Tesla is by far the world’s most valuable automotive company (more valuable than the next 9 companies together), but it is much more than that. Tesla’s latest strategy “Master Plan Part 3” describes how it plans to transform the future of energy.

1. Visionary Leadership

Elon Musk’s Vision: Tesla’s growth has been driven by the visionary leadership of Elon Musk. His bold vision of a sustainable future powered by electric vehicles (EVs) and renewable energy has been a cornerstone of Tesla’s strategy. Musk’s ability to articulate a compelling vision has inspired both investors and customers, creating a strong brand and loyal following.

2. Innovative Products

Electric Vehicles (EVs): Tesla revolutionized the automotive industry with its high-performance electric vehicles. The introduction of the Roadster in 2008 demonstrated that EVs could be both powerful and desirable. Subsequent models, such as the Model S, Model X, Model 3, and Model Y, have combined cutting-edge technology with luxury, performance, and affordability.

Autonomous Driving: Tesla’s continuous development of autonomous driving technology, through its Autopilot and Full Self-Driving (FSD) systems, has set it apart from competitors. This innovation has attracted tech-savvy consumers and positioned Tesla as a leader in automotive technology.

3. Sustainable Energy Solutions

Energy Products: Beyond automobiles, Tesla has expanded into sustainable energy solutions. The introduction of Tesla Energy products, including solar panels, Solar Roof, and the Powerwall and Powerpack energy storage systems, has broadened Tesla’s market and aligned with its mission to accelerate the world’s transition to sustainable energy.

Gigafactories: Tesla’s Gigafactories have been crucial in scaling production and reducing costs. These massive facilities, designed to produce batteries and vehicles at unprecedented scales, have enabled Tesla to meet growing demand and achieve economies of scale.

4. Direct-to-Consumer Sales Model

Retail Strategy: Tesla’s direct-to-consumer sales model, bypassing traditional car dealerships, has allowed it to maintain closer relationships with customers and better control the buying experience. Tesla showrooms and online sales platforms offer a seamless and customer-centric purchasing process.

Service and Supercharging Network: Tesla has invested heavily in its service centers and Supercharger network, enhancing the convenience and reliability of owning a Tesla vehicle. The extensive charging infrastructure supports long-distance travel and alleviates range anxiety, a common concern for EV owners.

5. Strategic Market Expansion

Global Presence: Tesla has strategically expanded its market presence globally. The construction of Gigafactory Shanghai in China and Gigafactory Berlin in Germany has not only increased production capacity but also allowed Tesla to tap into key international markets, reducing reliance on imports and tariffs.

Market Segmentation: By introducing a range of models at different price points, Tesla has catered to various market segments. The Model 3 and Model Y have made Tesla vehicles accessible to a broader audience, driving significant sales growth.

6. Financial Performance and Investment

Strong Financials: Tesla’s financial performance has been marked by consistent revenue growth and increasing profitability. The company’s ability to achieve profitability in 2013 and sustain it has bolstered investor confidence and facilitated further investment in innovation and expansion.

Stock Market Success: Tesla’s stock market performance has been extraordinary, attracting significant investor interest and capital. The company’s inclusion in the S&P 500 index in 2020 further validated its growth trajectory and increased its visibility among institutional investors.

7. Brand and Market Perception

Brand Loyalty: Tesla has cultivated a strong brand with a loyal customer base. The company’s commitment to sustainability, innovation, and performance has resonated with consumers, creating a powerful brand identity.

Media and Public Relations: Elon Musk’s active presence on social media and in the public eye has kept Tesla in the news, generating free publicity and maintaining high levels of consumer interest and engagement.

8. Strategic Partnerships and Alliances

Collaborations: Tesla has formed strategic partnerships to enhance its capabilities and market reach. Collaborations with companies in the tech and energy sectors have facilitated advancements in battery technology, autonomous driving, and energy solutions.

Government Incentives: Tesla has also benefited from government incentives and subsidies for electric vehicles and renewable energy. These incentives have made Tesla products more affordable for consumers and supported the company’s growth.

9. Adaptation and Resilience

Crisis Management: Tesla’s ability to navigate challenges, such as production delays, supply chain disruptions, and regulatory hurdles, has demonstrated its resilience. The company’s agility in addressing these issues and maintaining growth momentum has been a key factor in its success.

Continuous Improvement: Tesla’s culture of continuous improvement, from manufacturing processes to product features, ensures that it remains at the forefront of innovation and efficiency. This commitment to excellence drives ongoing growth and market leadership.

In summary, Tesla’s growth over the years has been driven by visionary leadership, innovative products, sustainable energy solutions, a direct-to-consumer sales model, strategic market expansion, strong financial performance, a powerful brand, strategic partnerships, and a culture of adaptation and resilience. These factors collectively have positioned Tesla as a dominant force in the automotive and energy industries.

Tony’s Chocolonely

Dutch journalist Teun van de Keuken founded the chocolate company in 2005 to fight against modern slavery on cocoa farms.

Over 10 years it grew 10x, 24% a year, and a gross margin of 46%, and is the leading chocolate brand in the Netherlands. Its latest “fair” report starts with “Another choc-tastic year, proving that social impact and economic growth can soar together.”

1. Mission-Driven Purpose: Fighting Modern Slavery

Tony’s Chocolonely was founded with a strong mission to eradicate modern slavery and exploitation in the cocoa industry. This mission resonated deeply with consumers who are increasingly conscious of ethical sourcing and social responsibility. The company’s clear and compelling purpose attracted a loyal customer base that supports its cause, driving both brand loyalty and growth.

2. Transparency and Traceability

Tony’s Chocolonely prioritized transparency and traceability in its supply chain. The company established direct relationships with cocoa farmers, ensuring fair trade practices and better working conditions. By highlighting these ethical practices, Tony’s built trust with consumers and differentiated itself in a crowded market. Transparency in sourcing not only appealed to ethically-minded consumers but also set a standard for the industry.

3. Unique Product Offering

Tony’s Chocolonely introduced unique and high-quality chocolate products that stood out in the market. The brand is known for its irregularly divided chocolate bars, symbolizing the unequal distribution of income in the chocolate industry. This distinctive product design, combined with a focus on superior taste and quality, helped attract a wide range of consumers and create a strong brand identity.

4. Effective Storytelling and Marketing

The company employed effective storytelling to communicate its mission and values. Through engaging narratives and compelling content, Tony’s Chocolonely educated consumers about the issues in the cocoa industry and their role in supporting ethical practices by choosing Tony’s products. This approach not only raised awareness but also fostered an emotional connection with the brand, driving customer loyalty and word-of-mouth marketing.

5. Strategic Market Expansion

Tony’s Chocolonely strategically expanded its presence in both local and international markets. Starting in the Netherlands, the company gradually entered other European markets and later expanded to the United States and beyond. Careful market selection and targeted marketing campaigns ensured that Tony’s products reached the right audience, contributing to steady growth.

6. Innovative Collaborations and Partnerships

The company engaged in innovative collaborations and partnerships to amplify its reach and impact. By partnering with other ethical brands and organizations, Tony’s Chocolonely expanded its network and visibility. These collaborations often resulted in co-branded products or joint marketing efforts, enhancing brand recognition and driving sales.

7. Focus on Sustainability and Social Impact

Tony’s Chocolonely’s commitment to sustainability and social impact played a crucial role in its growth. The company continuously worked on improving its environmental footprint and supporting cocoa farming communities. By aligning its growth strategy with sustainable practices, Tony’s appealed to eco-conscious consumers and positioned itself as a leader in responsible business practices.

8. Engaging Packaging and Branding

The vibrant and colorful packaging of Tony’s Chocolonely products caught consumers’ attention on store shelves. The bold and playful design, coupled with clear messaging about the company’s mission, made the products easily recognizable and memorable. Effective branding helped create a strong visual identity, contributing to brand recall and customer loyalty.

9. Active Community Engagement

Tony’s Chocolonely actively engaged with its community of supporters through social media, events, and educational initiatives. The company encouraged consumers to participate in its mission, share their stories, and advocate for ethical practices. This active engagement fostered a sense of community and shared purpose, strengthening customer relationships and driving brand advocacy.

10. Continuous Innovation and Product Development

Tony’s Chocolonely continually innovated and expanded its product line to meet changing consumer preferences. The company introduced new flavors, limited editions, and seasonal products, keeping the brand fresh and exciting. Continuous product development not only catered to existing customers but also attracted new ones, contributing to sustained growth.